Sign Up For Updates

ProgressNow Colorado is the state’s largest and most effective multi-issue progressive organization.

We communicate our ideals through high-quality video, cutting-edge digital marketing campaigns, and a full scope of storytelling for progressive values and issue-aligned organizations in Colorado.

Leveraging digital and traditional media to help our partners reach their audience where they are.

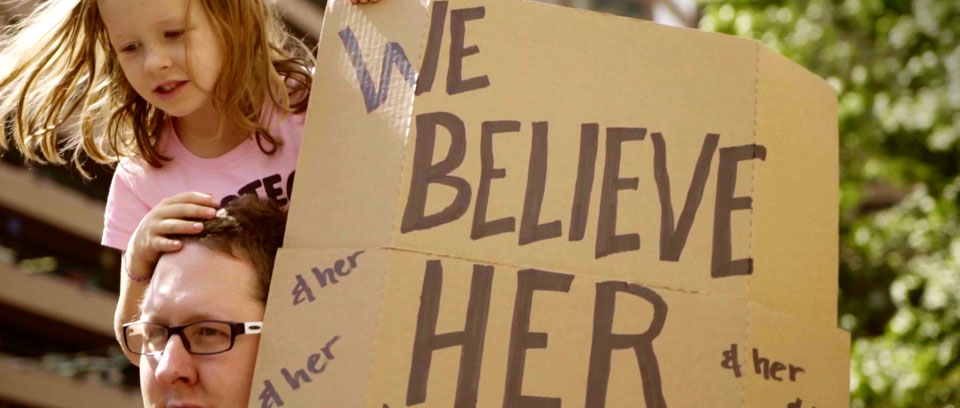

We connect audiences with progressive values–online, on mobile devices, in homes, and at community events so Coloradans can take action at demonstrations, in the state capitol, at press conferences, at the ballot box, and more.

we are the storytellers of the movement.

Video

Production

We’re telling the stories of Colorado and Coloradans through dynamic and engaging videos. We’re filming and producing video for mission-aligned organizations, rapid response needs, and our long-term projects.

Issue Advocacy

We advocate on issues and policy that impact the lives of Coloradans. We help to educate the public on policy and listen to the public on the issues that matter the most to them. We’re committed to working with grassroots activists and groups to support them however we can.

Issue Advocacy

We advocate on issues and policy that impact the lives of Coloradans. We help to educate the public on policy and listen to the public on the issues that matter the most to them. We’re committed to working with grassroots activists and groups to support them however we can.

LET’S TEAM UP

Digital Campaign

Management

We work to reach Coloradans where they are online, through various content, copywriting, and advertising. We leverage our platforms to reach (almost) everyone.

Press Relations

We work closely with local and national media outlets to provide helpful, accurate, and timely information.

Press Relations

We work closely with local and national media outlets to provide helpful, accurate, and timely information.

we are

INTENTIONAL

AUTHENTIC

HONEST

BOLD

COMMUNITY DRIVEN

HUMAN CENTERED

we are

INTENTIONAL

AUTHENTIC

HONEST

BOLD

COMMUNITY DRIVEN

HUMAN CENTERED